FREEPORT, BAHAMAS. 00:38 EST, MONDAY 27 FEB.

There are plenty of unintentionally funny sights to be seen in the Bahamas.

Website domains end in ‘.BS’…

The dominant telecoms company is called ‘BTC’…

The US embassy is directly beside McDonalds…

The central bank is adjacent to the pirate museum…

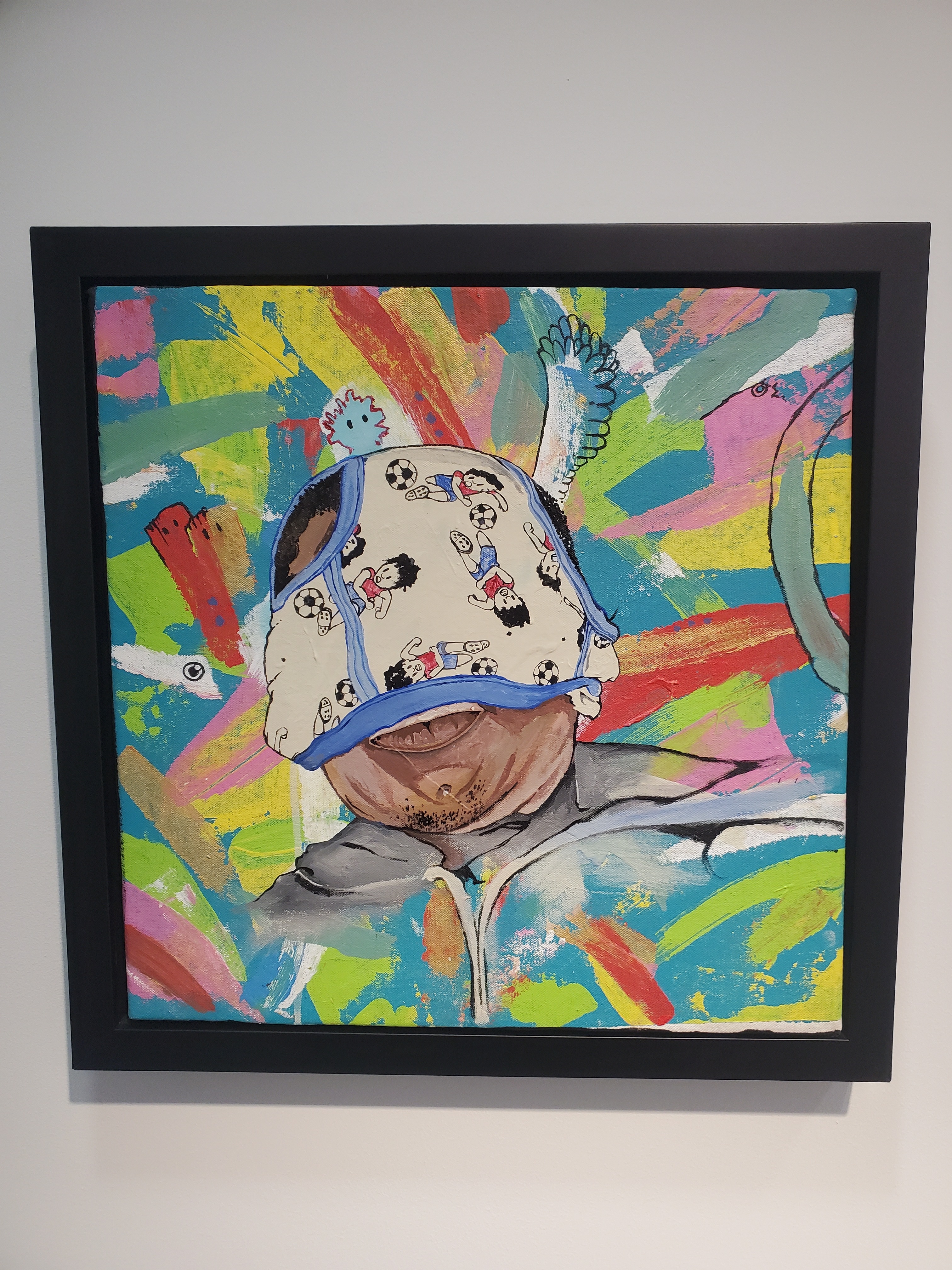

…And there’s a painting of a man wearing his underwear over his face inside of it.

If only other central banks could be so open. So honest with the public.

None of the details of the painting are visible. It’s one of those dumb gimmicks where you’re meant to download an app and scan the artwork to know who made it etc. I didn’t bother: ‘the art spoke for itself’, as unemployed university graduates like to say.

Central banks in the developed world should follow the Bahamian example and display similarly honest depictions of central bankers on their walls. The European Central Bank (ECB) owns hundreds of so-called ‘works of art’, and I can guarantee that none will be this relevant.

This is just one of the curiosities one can discover at the Central Bank of The Bahamas (CBB). While the institution doesn’t occupy headlines the way the Fed and the ECB can, it’s actually much further ahead of the curve than both in one key respect.

Market commentators like to decry the ominous coming of Central Bank Digital Currencies (CBDCs) every few years. But most forget that a CBDC already exists out in the wild: the Bahamian Sand Dollar.

To be clear, CBDCs do represent a Clear & Present Threat(TM). By phasing out physical cash (either outright through a ban, by nudging it into obsolescence through various incentives/disincentives, or just by waiting for zoomers to become a dominant demographic) and replacing it with a shitcoin they can create or destroy at a whim, our financial overlords would create a fastlane to a dystopian future.

…Thing is, this has been the case for decades. The RAND Corporation correctly described a fully electronic money-system with no blind spots as the perfect societal control/surveillance system as early as 1970 (more on this in a later note).

Why are CBDCs gonna be shoved down our throats and into our wallets now?

Market commentators cyclically warn of a CBDC roll-out every few years in a tradition that began (as far as I can tell) since Lehman Brothers got rekt.

‘The Curse of Cash’ by Ken Rogoff is periodically ponied about to warn of their arrival, with paper-cash maximalists ironically juicing the royalty cheques of the consummate technocrat each time.

When nominal interest rates are at zero or negative, the pressure to phase out cash is at its highest. But it’s a nuclear option. A weapon you only use when you feel you are running out of options. It cannot be initiated by central bank alone, requiring significant support and co-ordination from the other branches of government.

With the inflation genie now thoroughly out of the bag, the pressure to do this is relieved. Financial repression (dealing with a government debt problem by stomping savers to death) can take place without such overt measures. All that is required is for the central bank to raise interest rates a little and look like it’s doing something, while keeping said rates well below the rate of inflation. This is what is taking place now.

You could always create a CBDC in the meantime, for when/if inflation collapses. But we can look to the Bahamas for an example of how well this actually works when paper cash is still in circulation (spoiler: not well).

The Bahamian Sand Dollar has been around for a while, first launching in October 2020. And yet nobody in the Bahamas seems to have heard about it. I couldn’t find anyone in Nassau who even recognised the logo. The electronic payment system that was visible was SunCash, a Fintech product from the private sector.

Moral of the tale: if you want people to use CBDCs, you’re gonna need to phase out cash, because central banks are so incompetent that they won’t be able to create an electronic payment system more appealing than Fintech firms.

The man pictured with his pants on his head in the CBB may as well be the man running the Sand Dollar launch. Sanddollar.bs has an appropriate web domain.

Until next time,

Jim Hawkins

The Treasure Island Times